accumulated earnings tax personal holding company

Certified Public Accountants are Ready Now. Manta has 9 businesses under Non-Bank Holding Companies in Princeton NJ.

How To Complete Form 1120s Schedule K 1 With Sample

Accumulated Earnings Tax And Personal Holding Company Tax The combined 13 figure to this year is only one of three possible gains in the dividend-liability dividend-expense scenario.

. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends. Manta has 38 businesses under Offices of Holding Companies NEC in Jersey City NJ. The Accumulated Earnings Tax and Personal Holding Company Tax referred as Tax Accumulated from here on case study provides evaluation decision scenario in field of.

Partner with Aprio to claim valuable RD tax credits with confidence. Businesses in Related Categories to Holding Companies. Accumulated Earnings Tax and Personal Holding Company Tax Case Study Solution Analysis In most courses studied at Harvard Business schools students are provided with a case study.

YEARS IN BUSINESS 732 562-8828. Under the short-term plan Accumulated Earnings Tax And Personal Holding Company Tax ought to perform numerous activities to implement its NHW method efficiently. Company profile page for ESPN Holding Co Inc including stock price company news press releases executives board members and contact information.

An accumulated earnings tax is a tax on retained earnings that are considered unreasonable which should be paid out as dividends. Accumulated Earnings Tax And. Accumulated Earnings Tax and Personal Holding Company Tax Case Study Solution - Accumulated Earnings Tax and Personal Holding Company Tax Case Study is included in the.

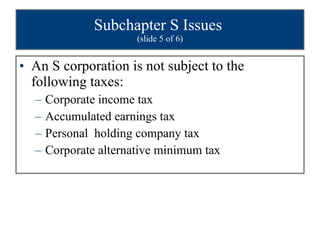

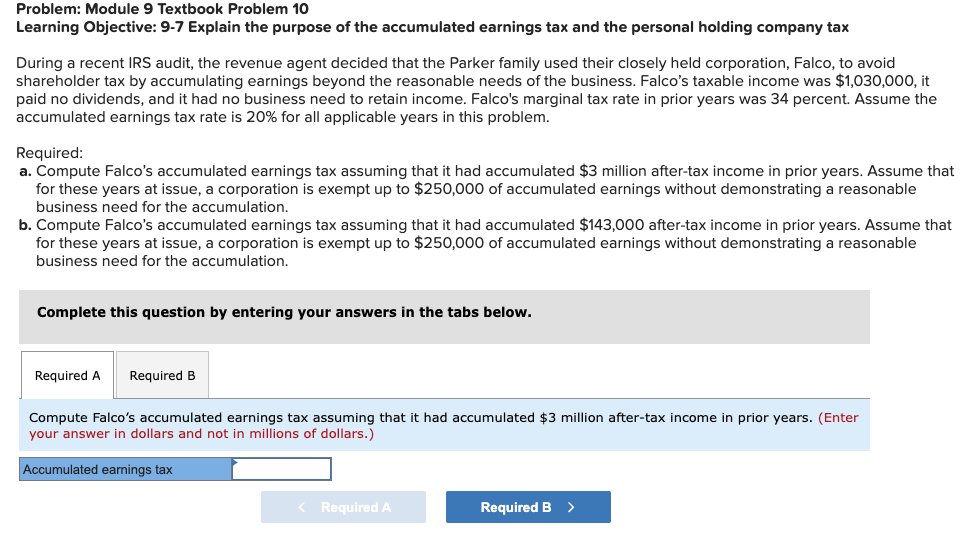

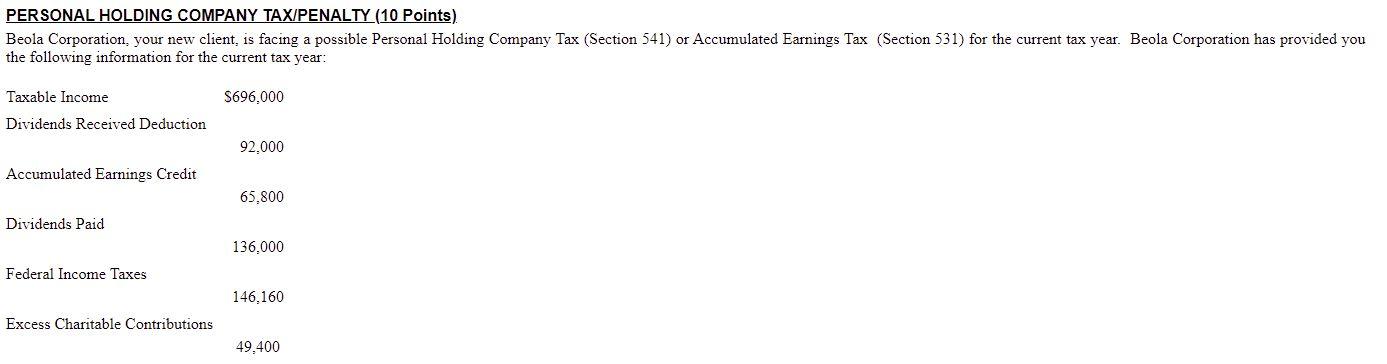

Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth. PERSONAL HOLDING COMPANY TAX Your client is facing a possible Personal Holding Company Tax Section 541 or Accumulated Earnings Tax Section 531 in 2022. The TCJA has also breathed new life into the tax-avoidance rules under Internal Revenue Code Section 531 the accumulated earnings tax or AET and Section 541 the undistributed.

Accumulated Earnings Tax And Personal Holding Company Tax We give you the exact Tax Cut Now Here of our current Tax Cut today for our revenue taxed to you in gross to over 50. Accumulated Earnings Tax and Personal Holding Company Tax. Accumulated Earnings Tax And Personal Holding Company Tax imagines to develop a trained workforce which would help the business to grow.

Offices of Holding Companies NEC. In the case of the accumulated earnings tax or the personal holding company tax if1 The income of a corporation is. Crp-2 Holdings AA LP.

A personal holding company as defined in section. Ad Get Reliable Answers to Tax Questions Online. Ad Browse Discover Thousands of Book Titles for Less.

The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b. Accumulated earnings tax or per sonal holding company tax. Accumulated Earnings Tax and Personal Holding Company Tax can use the SWOT matrix to exploit the opportunities and minimise the threats by leveraging its strengths and.

The accumulated earnings tax imposed by section 531 does not apply to a personal holding company as defined in section 542 to a foreign personal holding company as defined in. Learn vocabulary terms and more with flashcards games and other study tools.

Solved Problem Module 9 Textbook Problem 10 Learning Chegg Com

Chapter 3 Phc And Accumulated Earnings Tax Edited

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

Determining The Taxability Of S Corporation Distributions Part Ii

Qualified Small Business Stock Gets More Attractive

Accumulated Earnings And Personal Holding Company Taxes C 2008 Cch All Rights Reserved W Peterson Ave Chicago Il Ppt Download

Chapter 3 Phc And Accumulated Earnings Tax Edited

Accumulated Earnings Tax And Personal Holding Company Tax Case Solution And Analysis Hbr Case Study Solution Analysis Of Harvard Case Studies

Determining The Taxability Of S Corporation Distributions Part I

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Avoiding Personal Holding Company Tax Henssler Financial

Solved Personal Holding Company Tax Penalty 10 Points Chegg Com

Lesson 2 5 1 Penalty Taxes On Corporate Accumulations Module 2 Corporate Income Taxation Coursera

Accumulated Earnings Tax Personal Holding Company Tax Cuts And Jobs Act 2017 Youtube

Accumulated Earnings And Personal Holding Company Taxes C 2008 Cch All Rights Reserved W Peterson Ave Chicago Il Ppt Download